Milliman analysis shows superior asset returns through the first half of 2019 have helped many plans bounce back from 2018

Milliman’s Fall 2019 Multiemployer Pension Funding Study is an interim update to our annual study published in the spring. This study updates the estimated funded status of U.S. multiemployer plans as of June 30, 2019, showing the change in funding levels from December 31, 2018.

Key findings

- The estimated investment return for our simplified portfolio for the first six months of 2019 was about 13.4%, nearly double many plans’ annual investment return assumption.

- Overall, multiemployer plans have recovered much of the investment losses suffered during 2018.

- The aggregate funded percentage for multiemployer plans is estimated to be 82% as of June 30, 2019, up from 74% at the end of 2018.

- For most troubled plans, the rebound in funded status is not as pronounced.

Current funded percentage

Figure 1 shows that the funding shortfall for all plans decreased by about $52 billion for the six-month period ending June 30, 2019, resulting in an increase in the aggregate funded percentage from 74% to 82%. This analysis uses the market value of assets, which paints a clearer current financial picture than using smoothed “actuarial” asset values.

Figure 1: Aggregate funded percentage (in $ billions)

| 12/31/2018 | 6/30/2019 | Change | |

| Accrued benefit liability | $678 | $686 | $8 |

| Market value of assets | $502 | $562 | $60 |

| Shortfall | $176 | $124 | $(52) |

| Funded percentage | 74% | 82% | 8% |

| Based on plans with complete IRS Form 5500 filings. Includes 1,251 plans as of December 31, 2018, and 1,245 plans as of June 30, 2019. | |||

A key assumption here is the discount rate used to measure liabilities, with each plan using its actuary’s assumed return on assets. Assumed returns are generally between 6% and 8%, with a weighted average interest rate assumption for all plans equal to 7.24%, 2 basis points lower than reported in our prior study.

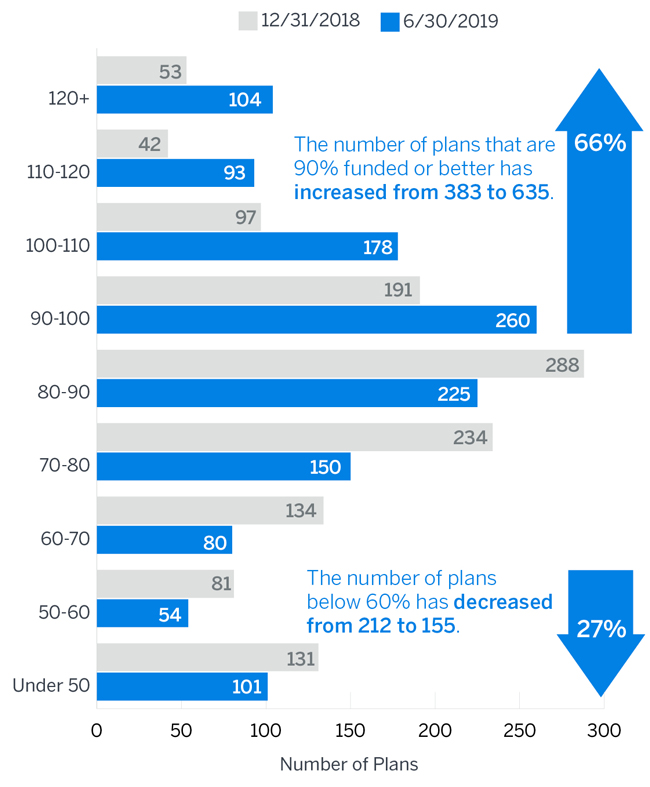

Figure 2 is a distribution of funded percentages for all plans in the study as of June 30, 2019, as compared to December 31, 2018.

Figure 2: Market value funded percentage (%)

As Figure 2 illustrates, there was significant upward movement of plans climbing from lower funded percentages to higher funded percentages over the six-month period ending June 30, 2019. This demonstrates just how impactful a few months of market returns can be on the funded status of plans. The number of plans funded 90% or better totaled 635 as of June 30, 2019, whereas just six months earlier, there were only 383 such plans. This equates to a 66% increase in the number of plans funded 90% or better. On the opposite end of the spectrum, the number of plans that were less than 60% funded dropped from 212 to 155 over the same six-month period. This equates to a 27% decrease in the number of plans below 60% funded. The improvement overall is not as pronounced for the worst-funded plans, particularly because of their maturity and cash flow issues.

Historical funded percentage

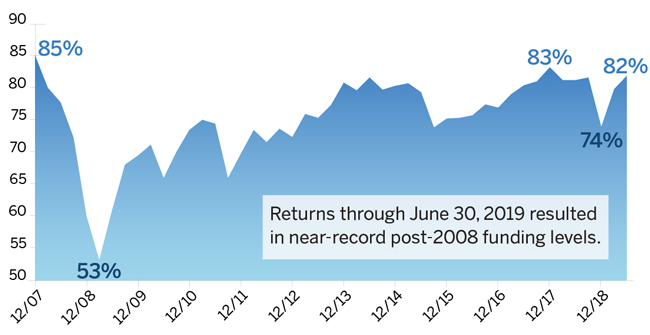

Figure 3 provides a historical perspective on the aggregate funded percentage of all multiemployer plans since the end of 2007.

Figure 3: Aggregate historical funded percentage market value basis

The aggregate funded percentage was 82% as of June 30, 2019, up from 74% at the end of 2018. Asset returns have materially exceeded expectations through the first six months of 2019, with some plans already earning double their assumed rates of return for the entire calendar year. Our simplified portfolio earned about 13.4% in the first six months of 2019. This is welcome news for plans, as it is coming off of a down year, where we had estimated a -5% return for calendar year 2018. As discussed in previous studies, the funded status of most plans continues to be almost entirely driven by investment performance. It is worth noting in Figure 3 that the aggregate funded percentage is once again close to the pre-2008 market crash level.

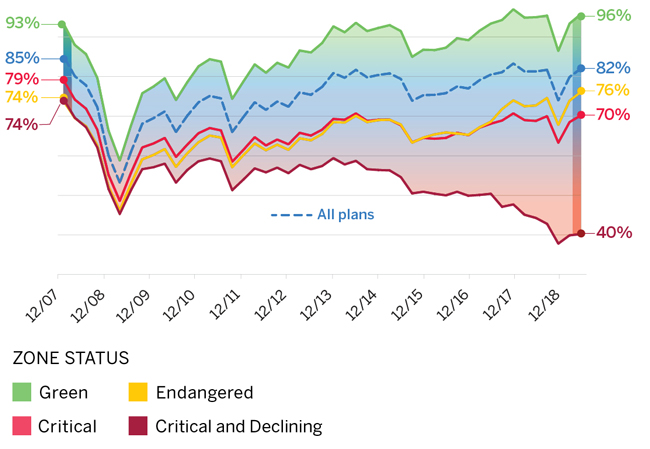

Figure 4 shows the historical funded percentage of all multiemployer plans since the end of 2007 by their current zone status. For example, the green line shows the historical funded percentages of plans currently in the green zone (without regard to their previous zone statuses). The blue dotted line represents all plans combined (which ties back to Figure 3).

Figure 4: Aggregate historical funded percentage by current zone status

The robust returns through the first six months of 2019 have resulted in most plans recouping the funded status losses experienced during 2018. Noncritical plans (the green and yellow lines) are presently a little better funded than they were at the end of 2007, prior to the global financial crisis. Critical plans (bright red) and critical and declining plans (dark red) are not as well funded as they were prior to 2008. In particular, it is significant to note that, even with the superb asset returns thus far in 2019, critical and declining plans have continued to struggle. As discussed in our Spring 2018 study regarding plan maturity, this struggle is largely due to their significant negative cash flow positions.

What lies ahead?

Potential changes in multiemployer plan law continue to be explored. In July, the House of Representatives passed the Rehabilitation for Multiemployer Pension Act (aka the Butch Lewis Act), which would create loan opportunities for the most troubled multiemployer plans. The Senate introduced its version of the bill, but its prospects of garnering enough support and ultimately passing through the Senate are uncertain.

In early August, the Pension Benefit Guaranty Corporation (PBGC) released its 2018 fiscal year projections report, stating that its multiemployer insurance program “continues on the path to running out of money by the end of fiscal year 2025.” Under current law, if the program runs out of money, the PBGC would have to reduce guaranteed benefits to levels that could be afforded by premium income only. As discussed in our recent Multiemployer Alert, this could result in drastic reductions to PBGC benefits paid to participants of insolvent plans.

Multiemployer plans will have to maintain a wait-and-see approach as various stakeholders debate the best course of action moving forward.

About this study

The results in this study were derived from publicly available Internal Revenue Service (IRS) Form 5500 data as of August 2019 for all multiemployer plans, numbering between 1,200 and 1,300, depending on the measurement date used. Data for a limited number of plans that clearly appeared to be erroneous was modified to ensure the results were reasonable and a sufficiently complete representation of the multiemployer universe.

Liability amounts were based on unit credit accrued liabilities reported on Schedule MB, and were adjusted to the relevant measurement dates using standard actuarial approximation techniques. For this purpose, each plan’s monthly cash flow, benefit cost, and actuarial assumptions were assumed to be constant throughout the year and in the future. Projections of asset values to the measurement date reflect the use of constant cash flows and monthly index returns for a simplified portfolio composed of 45% U.S. equities, 20% international equities, and 35% U.S. fixed income investments.

Significant changes to the data and assumptions could lead to much different results for individual plans, but would likely not have a significant impact on the aggregate results or the conclusions in this study.