The role of rebates in drug coverage decisions and insurer finances

For brand-name prescription drugs in competitive therapeutic classes, rebates are often the deciding factor when health insurers choose how to cover a drug, and how much a patient should pay for it.

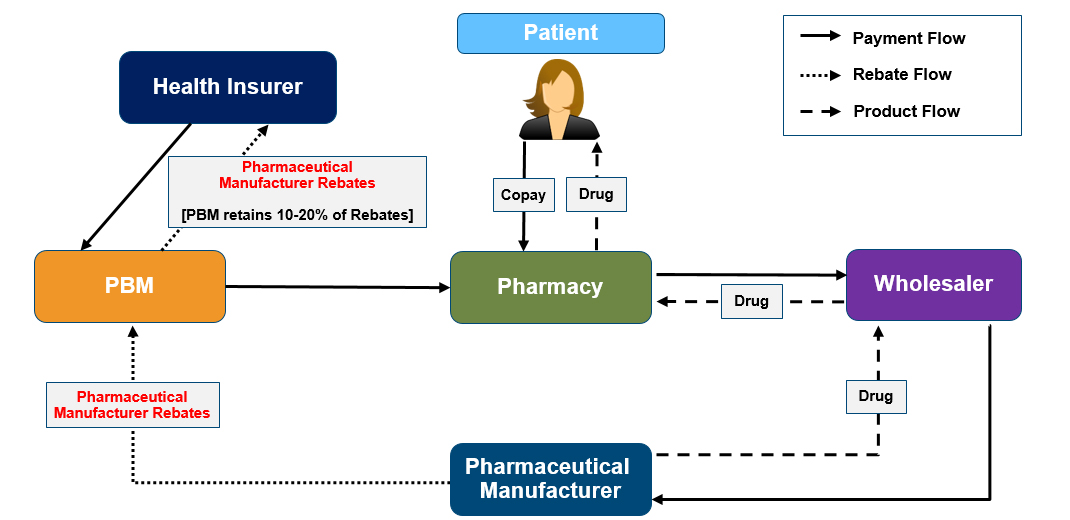

Many patients interact only with their doctors and pharmacies to obtain their prescription drugs. However, the prescription drug distribution chain is complex and involves several stakeholders. These stakeholders’ contracts determine how much a patient’s health insurance pays for prescription drugs and the patient’s out-of-pocket (OOP) costs. While there are many factors that influence how health insurers cover prescription drugs, pharmaceutical manufacturer rebates are one of the key drivers.

The May 2018 "American Patients First: The Trump Administration Blueprint to Lower Drug Prices and Reduce Out-of-Pocket Costs" from the U.S. Department of Health and Human Services (HHS) targets rebates as part of its goal to lower prescription drug prices. In this article, we explain the finances associated with rebates and their impact on health insurer coverage decisions.

What is a rebate?

To understand rebates, it is important to recognize the key stakeholders in the prescription drug distribution chain. There are generally six stakeholders in the supply and demand of prescription drugs: pharmaceutical manufacturers, health insurers (including self-insured employers), pharmacy benefit managers (PBMs), pharmacies, wholesalers, and patients (see Figure 1).

Figure 1: Key stakeholders in the prescription drug distribution chain

| STAKEHOLDER | ROLE | EXAMPLE ORGANIZATIONS |

| PHARMACEUTICAL MANUFACTURER | DEVELOP AND MARKET PRESCRIPTION MEDICATIONS | GENENTECH, PFIZER, SANOFI |

| HEALTH INSURER (INCLUDING PART D PLANS) | PROVIDE INSURANCE PRODUCTS TO PATIENTS THAT COVER HEALTHCARE SERVICES, INCLUDING PRESCRIPTION DRUGS | AETNA, CIGNA, EMPLOYERS, CENTER FOR MEDICARE AND MEDICAID SERVICES (CMS) |

| PHARMACY | DISPENSE PHARMACEUTICAL DRUGS TO PATIENTS | WALGREENS, RITE AID, DUANE REED, CVS, MAIL ORDER |

| PHARMACY BENEFIT MANAGER | INTERMEDIARY BETWEEN THE HEALTH INSURER AND THE PHARMACY. DEVELOP AND MAINTAIN FORMULARIES FOR HEALTH INSURERS, NEGOTIATES REBATES AND DISCOUNTS. | CAREMARK (PART OF CVS) EXPRESS SCRIPTS, PRIME THERAPEUTICS |

| WHOLESALER | DISTRIBUTES PHARMACEUTICAL DRUGS FROM THE PHARMACEUTICAL MANUFACTURER TO THE PHARMACY | AMERISOURCEBERGEN, CARDINAL HEALTH, MCKESSON |

| PATIENT | END USER OF A PRESCRIPTION DRUG |

A rebate is the return of part of the purchase price by the seller to the buyer. Rebates are used by a wide array of manufacturers, such as automakers, electronics companies, and pharmaceutical manufacturers, to drive demand for their products. Prescription drug rebates are generally paid by a pharmaceutical manufacturer to a PBM, who then shares a portion with the health insurer.1 Rebates are mostly used for high-cost brand-name prescription drugs in competitive therapeutic classes where there are interchangeable products (rarely for generics), and aim to incentivize PBMs and health insurers to include the pharmaceutical manufacturer’s products on their formularies and to obtain preferred “tier” placement.2

A formulary is the list of prescription drugs that a health insurer will cover; it assigns particular products to one of several tiers (typically two to four in commercial formularies) with different member cost sharing. These formularies are generally developed by PBMs, which negotiate contracted prescription drug prices and rebates with pharmaceutical manufacturers on behalf of their clients,3 the health insurers. Formulary tiers are often designed to promote low-cost prescription drugs; for example, a low-cost generic prescription drug may require a $5 copay, a preferred brand prescription drug with a rebate may require a $20 copay, and a non-preferred brand prescription drug without a rebate may require a $50 copay.

Rebate contract terms are trade secrets and vary widely among brands, pharmaceutical manufacturers, and health insurers, but tend to be highest for brands in therapeutic classes with competing products.4 This secrecy makes cost comparisons of competing brands on the basis of price alone very difficult (if not impossible) to estimate. Rebates therefore create a “black box” in the prescription drug distribution chain—the patient (and often the commercial health insurer) does not know how much the pharmaceutical manufacturers are paying in rebates, and how much of the rebates PBMs are keeping before passing the remainder to the health insurer.5 While average rebates are close to 20% of the price, some brands have no rebates and others are believed to offer rebates of over 60%.6

What are the finances of rebates?

Together with contracted prices, rebates are a key factor in deciding whether to include a specific prescription drug on a commercial health insurer’s formulary and in which tier. Therefore, rebates impact the finances of all stakeholders involved in the prescription drug distribution chain.

Figure 2: Rebates in the prescription drug distribution chain

Patients: Rebates are a key determinant of whether a patient’s prescribed drug is covered by health insurance, and at what patient OOP cost. In addition, patients usually pay a coinsurance percentage (for example, 20%) for high-cost brand-name and specialty drugs; however, because the coinsurance percentage is calculated based on the price of the prescription drug before the application of rebates, patients often pay a greater share of the true cost to the health insurer than the listed coinsurance percentage. See Figure 3 for an example calculation.

Pharmaceutical manufacturers: Rebates allow pharmaceutical manufacturers to increase sales and reported revenue for their products. However, they also contribute to the growing spread between pharmaceutical manufacturer’s pre-rebate “gross” and post-rebate “net” revenue. In recent years, pharmaceutical manufacturers have reported actual revenue of 50% to 60% of gross sales due to rebates and discounts.7,8,9

Health insurers: Rebates can directly reduce premiums by reducing health insurers’ costs of providing prescription drug benefits to their members. Similarly, revenue from rebates can be used by health insurers to provide more robust benefits (such as lower cost sharing) without the need to increase premiums.

PBMs: Rebates are an important component of PBMs’ business models, which often retain a portion of the rebates they negotiate with pharmaceutical manufacturers to contribute to their revenue.

Wholesalers and pharmacies: Rebates play an important role in formulary decisions and can therefore influence the demand for specific prescription drug brands from these suppliers.

Figure 3 illustrates the transactions involved for a hypothetical brand-name drug script with a negotiated price of $500, 20% patient coinsurance, and a 40% pharmaceutical manufacturer rebate, of which the PBM retains 15% of the rebate, or 6% of the negotiated price.

Figure 3: Prescription drug contract with rebates example

| STAKEHOLDER | TRANSACTION | BRAND | NOTES |

| HEALTH INSURER | GROSS COST | $500 | (A) |

| REBATES TO HEALTH INSURER | ($170) | (B)=30% REBATE FROM PBM | |

| NET COST | $330 | (C)=(A)-(B) | |

| PATIENT COINSURANCE | ($100) | (D)=20% PATIENT COINSURANCE | |

| NET COST TO HEALTH INSURER | $230 | (E)=(C)-(D) | |

| PBM | PBM NEGOTIATED REBATES | $200 | (F)=40% OF (A) |

| REBATES TO HEALTH INSURER | ($170) | (B) | |

| REBATES RETAINED BY PBM | $30 | (G)=15% PBM REBATE SPREAD | |

| PATIENT | PATIENT COINSURANCE | $100 | -(D) |

| GROSS COST | $500 | (A) | |

| NET COST | $330 | (C) | |

| SHARE OF GROSS COST | 20% | (H)=-(D)/(A) | |

| SHARE OF NET COST | 30% | (I)=-(D)/(C) | |

| PHARMACEUTICAL MANUFACTURER | GROSS REVENUE* | $450 | (J) |

| REBATES | ($200) | -(F) | |

| NET REVENUE | $250 | (K)=(J)+(F) | |

| GROSS MARGIN | 56% | (L)=(K)/(J) | |

| *Example assumes health insurer price is 10% higher than the manufacturer’s sale price; This amount is retained by intermediaries in the distribution channel (ie wholesalers and pharmacies). | |||

Figure 3 illustrates how rebates can cause a patient to pay a larger percentage of a health insurer’s net cost for a brand-name drug than the advertised coinsurance. In this example, the patient OOP of $100 equals the gross cost of the drug ($500) times the patient coinsurance (20%). The patient coinsurance brings the prescription drug cost to the health insurer down to $400. Furthermore, suppose the PBM has negotiated a 40% rebate ($200) from the pharmaceutical manufacturer on the gross cost, of which the PBM keeps 15% ($30) and passes the remaining amount ($170) to the health insurer. The net cost of the prescription drug to the health insurer is now $230 ($500 less $170 rebate less $100 patient cost sharing), not $400. If the insurer’s portion of the rebate were applied before the patient coinsurance, the gross cost would have been $330 ($500 less $170), and the patient would have paid $66 OOP (20% of $330), rather than $100 (20% of $500). However, this would result in an increase in the net cost to the health insurer. Currently, the $100 patient OOP represents 30% of the health insurer’s cost (after rebates) for the prescription drug, which is higher than the 20% listed coinsurance.

Depending on the price, rebate, and patient cost sharing, it is possible for the health insurer’s retained portion of the rebate on a brand-name prescription drug to exceed its liability. For example, suppose a prescription drug’s negotiated price is $100, with a patient cost sharing of $50 and a health insurer-retained rebate of $60. In this case the health insurer has a net gain of $10. Now suppose that the equivalent generic prescription drug has a negotiated price of $20 with a patient cost sharing of $10, resulting in a net health insurer cost of $10. In this case, the health insurer has a financial incentive to offer the brand-name prescription over the generic prescription drug.

Patient coinsurance is impacted by the negotiated price alone, as rebates are applied after purchase. Because commercial health insurance finances depend on the net price (after rebates) and not the negotiated price before rebates, health insurers may be indifferent to price/rebate offsets. However, this is not the case in Medicare Part D, as discussed further in this paper.

What happens when rebates change?

Rebate levels change each year as a result of negotiations between health insurers, PBMs, and pharmaceutical manufacturers. These changes can affect formulary placement, and usually become effective at the beginning of a new health insurance contract year.

For example, if the pharmaceutical manufacturer increases the rebate for a prescription drug, thereby lowering the net cost to the health insurer, that prescription drug may move from a formulary’s non-preferred tier to the preferred tier in the next contract year. This prescription drug will now be more affordable to the patient. In addition, the lower net cost may make the brand-name prescription drug more attractive to the health insurer than an alternative drug with a lower negotiated price (before rebates).

An increase in rebates, if passed to the health insurer by the PBM, may also result in a decrease in premiums or improved benefits10 for the members. Decreases in rebates are uncommon, because they would likely have a negative impact on formulary placement.

How is Medicare Part D different?

While the above dynamics are typical of the commercial market, some characteristics of Medicare Part D add important complexity:

- Pharmaceutical manufacturers and the federal reinsurance program cover portions of Medicare Part D spending. As a result, Medicare Part D plans pay only a portion of total prescription drugs costs after patient OOP. And while rebates lower the Medicare Part D plan’s overall costs, they do not affect patient cost sharing (similar to most commercial plans), which can be as high as 50% for non-preferred prescription drugs.11

- Unlike commercial health insurance, a large portion of Medicare Part D beneficiaries qualify for low-income cost-sharing subsidies, which reduce patient cost sharing for all prescription drugs. Health insurers with a large proportion of low-income beneficiaries may prefer brands with high rebates over lower-cost (and even generic) alternatives in their formularies, as these beneficiaries are insulated from the impact of coinsurance on brand-name drugs.

- The use of high-cost prescription drugs can quickly move beneficiaries through the Medicare Part D benefit phases. First, to the “donut hole” where in 2018 Medicare Part D plans are responsible for 15% of brand-name prescription drug costs and 56% of generic drug costs.12 Second, to the catastrophic zone, where the federal government is responsible for 80% of prescription drug cost.13 The relatively low liability of the Medicare Part D plans for brand-name prescription drugs makes rebates an important factor for inclusion of high-cost prescription drugs on formularies.

- While rebates are shared between the Medicare Part D plans and the government, the sharing formula means that the plans typically retain the majority of the rebates. Plans use these rebates to reduce member premiums and/or increase benefits. A very high rebate can mean that the Medicare Part D plan’s retained portion of the rebate exceeds its liability. In this case, the Medicare Part D plan would have a financial incentive to prefer a high-cost prescription drug over a lower-priced alternative, which would increase costs to patients and the federal government.14

A world without rebates?

The recent announcement by two national insurers that rebates will be shared with patients generated much debate,15 and may be a sign that health insurers are ready for a more transparent prescription drug distribution chain. The HHS’s "American Patients First" blueprint highlights the restriction of rebates as a way to potentially reduce prescription drug prices and patient OOP costs.16 While specific details are still unknown, two of the blueprint’s proposed changes could impact the current rebate system:

Eliminating the safe harbor under the Anti-Kickback statute for prescription drug rebates: This initiative would effectively remove the current incentives for preferred formulary placement by PBMs and health insurers based on rebate levels. This may increase transparency in net pricing and improve the competitiveness of generic and biosimilar products (especially in Medicare Part D), which could result in increased competition and lower prescription drug prices.

To the extent this action resulted in pharmaceutical manufacturers lowering their negotiated prices to a post-rebate level, some patients would benefit from lower OOP costs. The change would likely have a minimal impact on commercial health insurance premiums and benefits, although the demand for some high-cost brands may increase as patient OOP costs decreased (these dynamics are different in Medicare Part D). However, if negotiated prices fail to drop to the post-rebate level, health insurers would be forced to increase premiums or reduce benefits for their members to maintain their target margins. Additionally, eliminating rebates could drastically change the business model of PBMs.

Requiring Medicare Part D plans to apply a substantial portion of rebates at the time of purchase: Applying a portion of rebates to the negotiated price of a product would reduce OOP cost for certain Medicare Part D patients, as coinsurance would be calculated on a lower purchase price. This initiative would reduce the share of rebates retained by the health insurer, which could then reduce or even eliminate the current incentives to include higher-price/higher-rebate products in Medicare Part D formularies. This proposal ties into President Trump’s fiscal year (FY) 2019 budget,17 which includes a five-step plan to modernize Medicare Part D. The budget includes the shifting of costs for catastrophic prescription drug spending from the government to Medicare Part D plans, which is intended to promote negotiation of lower prices for high-cost prescription drugs.

As regulators and legislators continue to evaluate policies that could restrict the use of rebates by pharmaceutical manufacturers, it is important to understand the role of rebates in the prescription drug distribution chain and the incentives they create for the various stakeholders.

1Sometimes rebates include payments made by pharmaceutical manufacturers to wholesalers or pharmacies, or by pharmacies to PBMs or health insurers. These rebates are not considered in this paper.

2AMCP. Maintaining the Affordability of the Prescription Drug Benefit: How Managed Care Organizations Secure Price Concessions From Pharmaceutical Manufacturers. Retrieved May 20, 2018, from http://www.amcp.org/WorkArea/DownloadAsset.aspx?id=9299.

3Pharmaceutical Care Management Association. Drug Price Negotiations and Rebates. Retrieved May 20, 2018, from https://www.pcmanet.org/policy-issues/drug-price-negotiations-rebates/.

4MedPAC (March 2016). Chapter 13: Status Report on Part D. Report to the Congress: Medicare Payment Policy. Retrieved May 20, 2018, from http://www.medpac.gov/docs/default-source/reports/chapter-13-status-report-on-part-d-march-2016-report-.pdf?sfvrsn=0.

5Managed Care (June 7, 2016). Rebates and coupons run rampant in diabetes. Retrieved May 20, 2018, from https://www.managedcaremag.com/archives/2016/5/rebates-and-coupons-run-rampant-diabetes.

6Visante (February 2016). Pharmacy Benefit Managers (PBMs): Generating Savings for Plan Sponsors and Consumers. Retrieved May 20, 2018, from http://thatswhatpbmsdo.com/wp-content/uploads/2016/02/visante-pbm-savings-study-Feb-2016.pdf.

7Pharmaceutical manufacturer’s actual revenue is impacted by a number of price concessions, including rebates. In this paper, we only discuss the rebates paid to PBMs and health insurers for formulary access and tier placement.

8 Drug Channels (March 20, 2018). Janssen's new transparency report: A peek behind the drug pricing curtain raises troubling questions about rebates. Retrieved May 20, 2018, from http://www.drugchannels.net/2018/03/janssens-new-transparency-report-peek.html.

9Novo Nordisk Annual Report 2017. Retrieved May 20, 2018, from https://www.novonordisk.com/content/dam/Denmark/HQ/investors/irmaterial/

annual_report/2018/NN-AR17_UK_Online1.pdf.

11Centers for Medicare and Medicaid Services, April 3, 2017, Note to: Medicare Advantage Organizations, Prescription Drug Plan Sponsors, and Other Interested Parties, https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Downloads/Announcement2018.pdf

12Plan liability is being reduced to only 5% in 2019, which further exacerbates this dynamic.

13Dusetzina, Stacie B. et al. (2017). Association of prescription drug price rebates in Medicare Part D with patient out-of-pocket and federal spending. JAMA Internal Medicine 177.8: 1185–1188.

14MedPAC (March 2017). Report to the Congress: Medicare Payment Policy. Retrieved May 20, 2018, from http://medpac.gov/docs/default-source/reports/mar17_entirereport.pdf.

15Murphy, T. (April 11, 2018). Insurers look to pass drug price breaks straight to consumer. Chicago Tribune. Retrieved May 20, 2018, from http://www.chicagotribune.com/business/ct-biz-drug-price-rebate-20180411-story.html.

16HHS (May 2018). American Patients First. Retrieved May 20, 2018, from https://www.hhs.gov/sites/default/files/AmericanPatientsFirst.pdf.

17Office of Management and Budget. Fiscal Year 2019: An American Budget. Retrieved May 20, 2018, from https://www.whitehouse.gov/wp-content/uploads/2018/02/budget-fy2019.pdf.