The principles-based approach under International Financial Reporting Standard 17 (IFRS 17) is both a blessing and a curse. In this paper, we cover the challenge of quantifying an illiquidity premium and discuss some practical considerations for reference portfolios. We look at asset markets to provide a measure, giving our observations on the use of a broad market benchmark portfolio, an illiquid market benchmark portfolio, and an actual asset portfolio. We then discuss the degree to which any illiquidity premium derived from a portfolio is subject to risk. A case study follows to highlight some of the considerations insurers should make when using different approaches when setting discount rates.

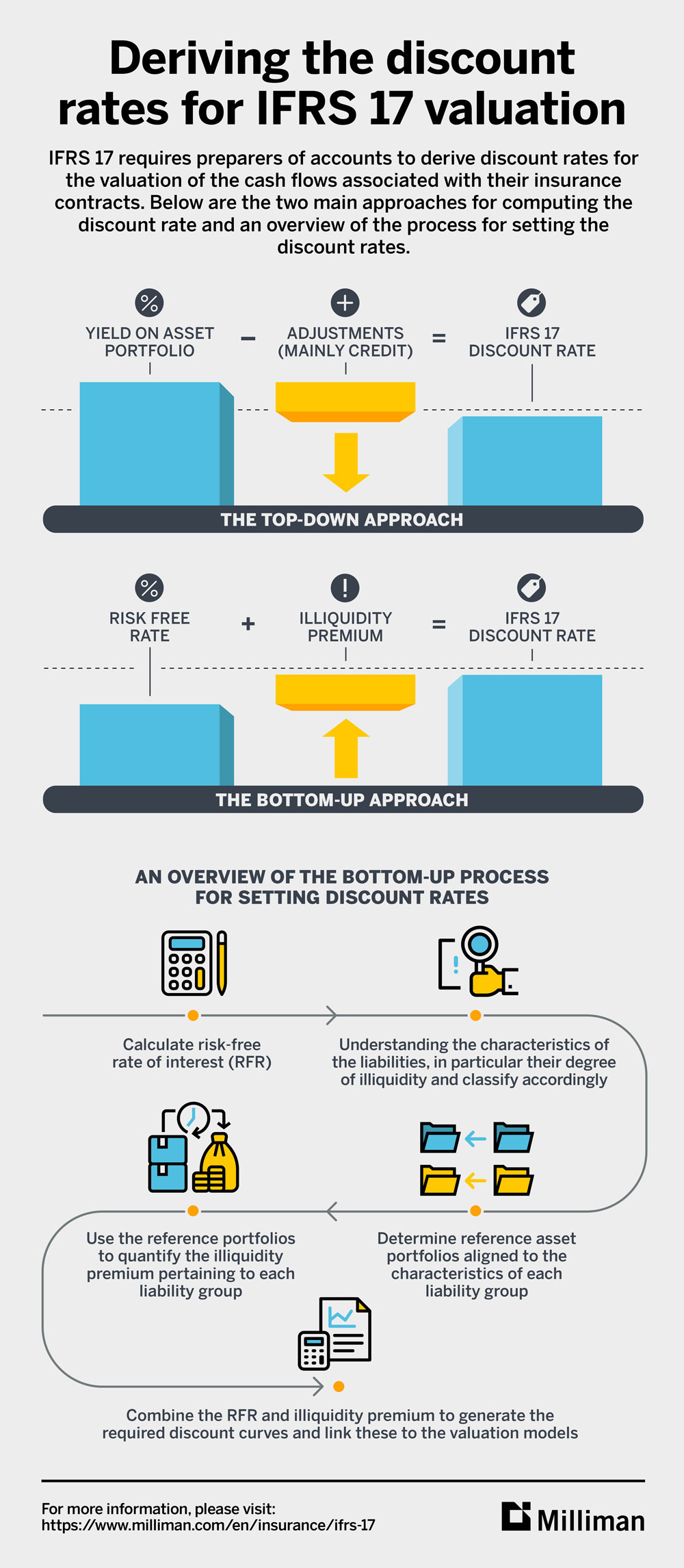

Below is an infographic that highlights the two main approaches for computing the discount rate and an overview of the process for setting the discount rates