Milliman FRM Market Commentary: October 2019

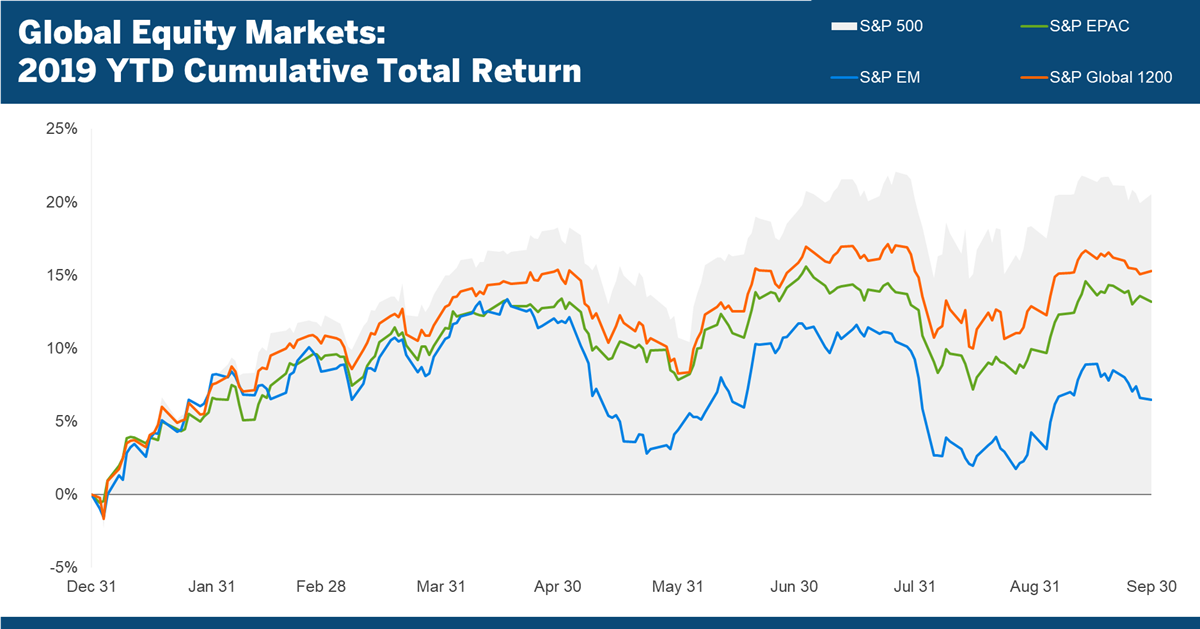

Global equities rallied in September, recovering all of their losses from August and notching their third consecutive quarter of positive returns:

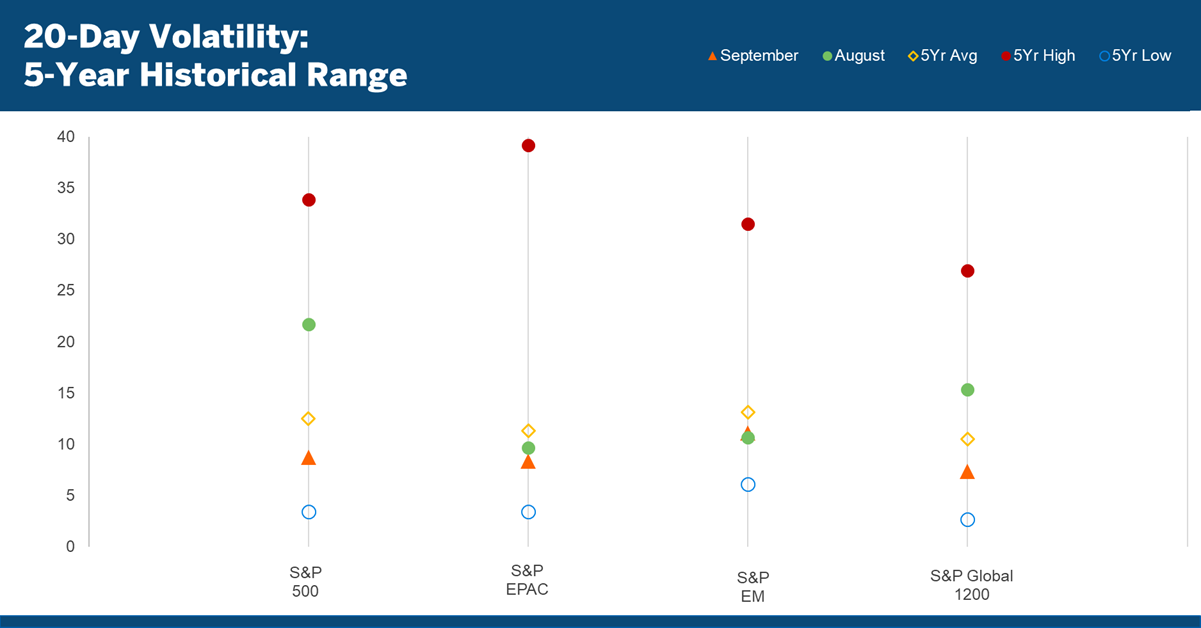

After rising in August, equity market volatility edged lower in September as earnings season begins:

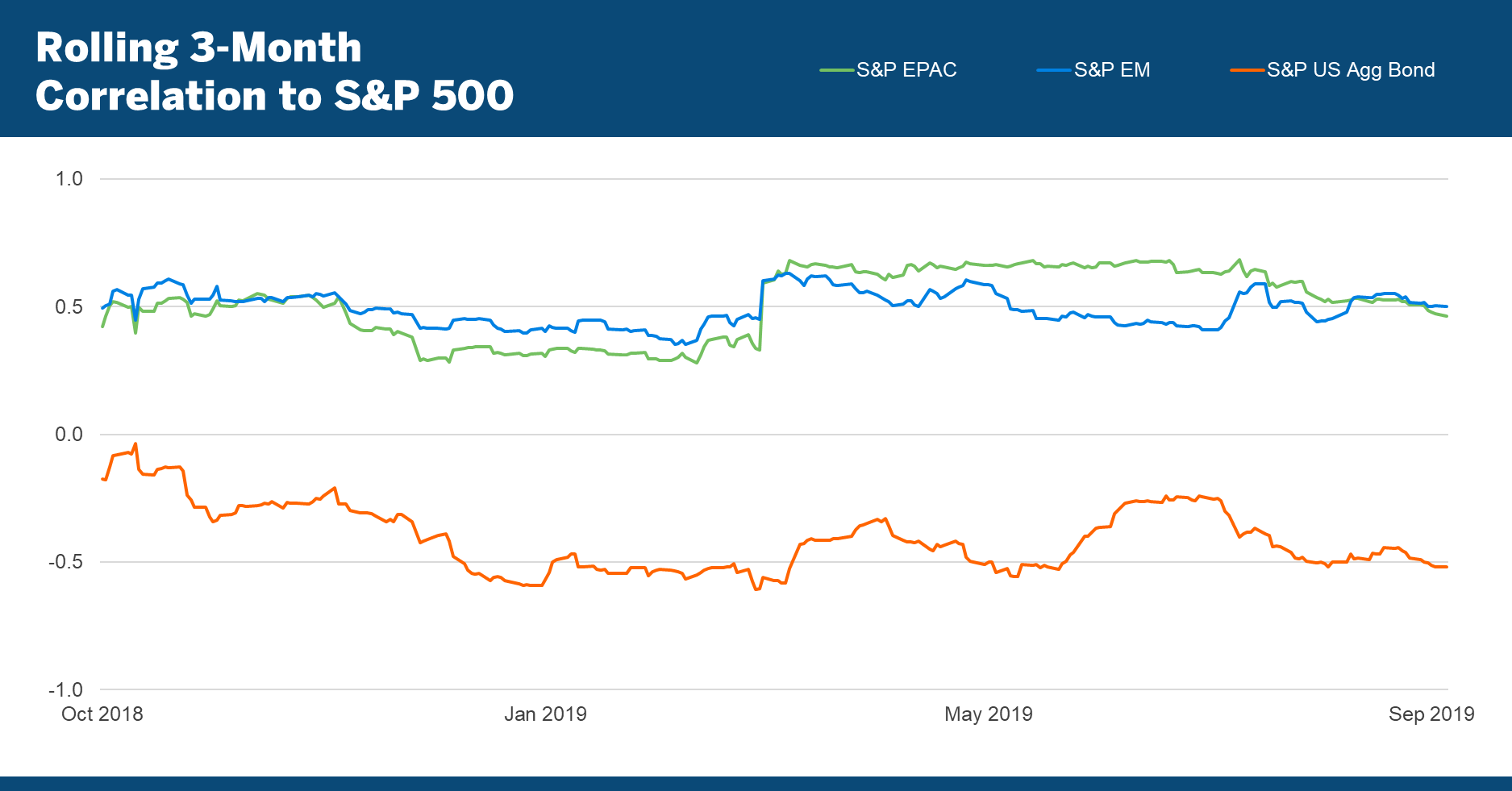

The S&P 500’s correlation to international stocks and to the US aggregate bond market remained relatively stable and finished the month unchanged:

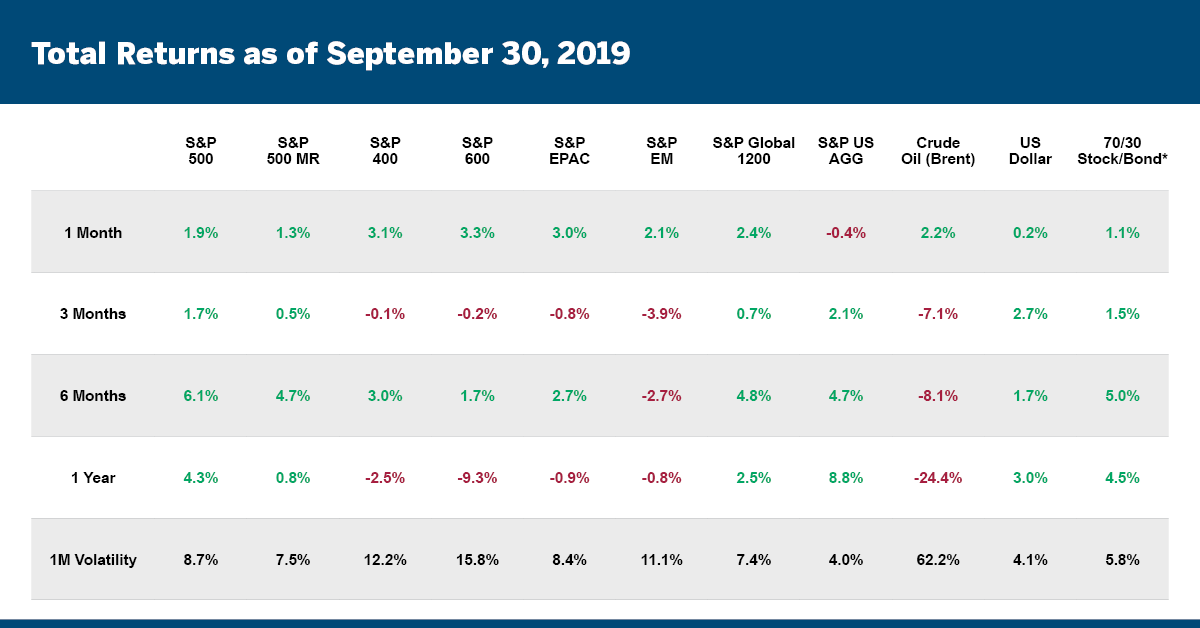

Equity gains in September stretched far and wide. Whether US large-, mid- or small-cap, or developed or emerging markets, all major segments of the stock market moved higher. In the US, with the exception of health care, every sector also generated a positive return:

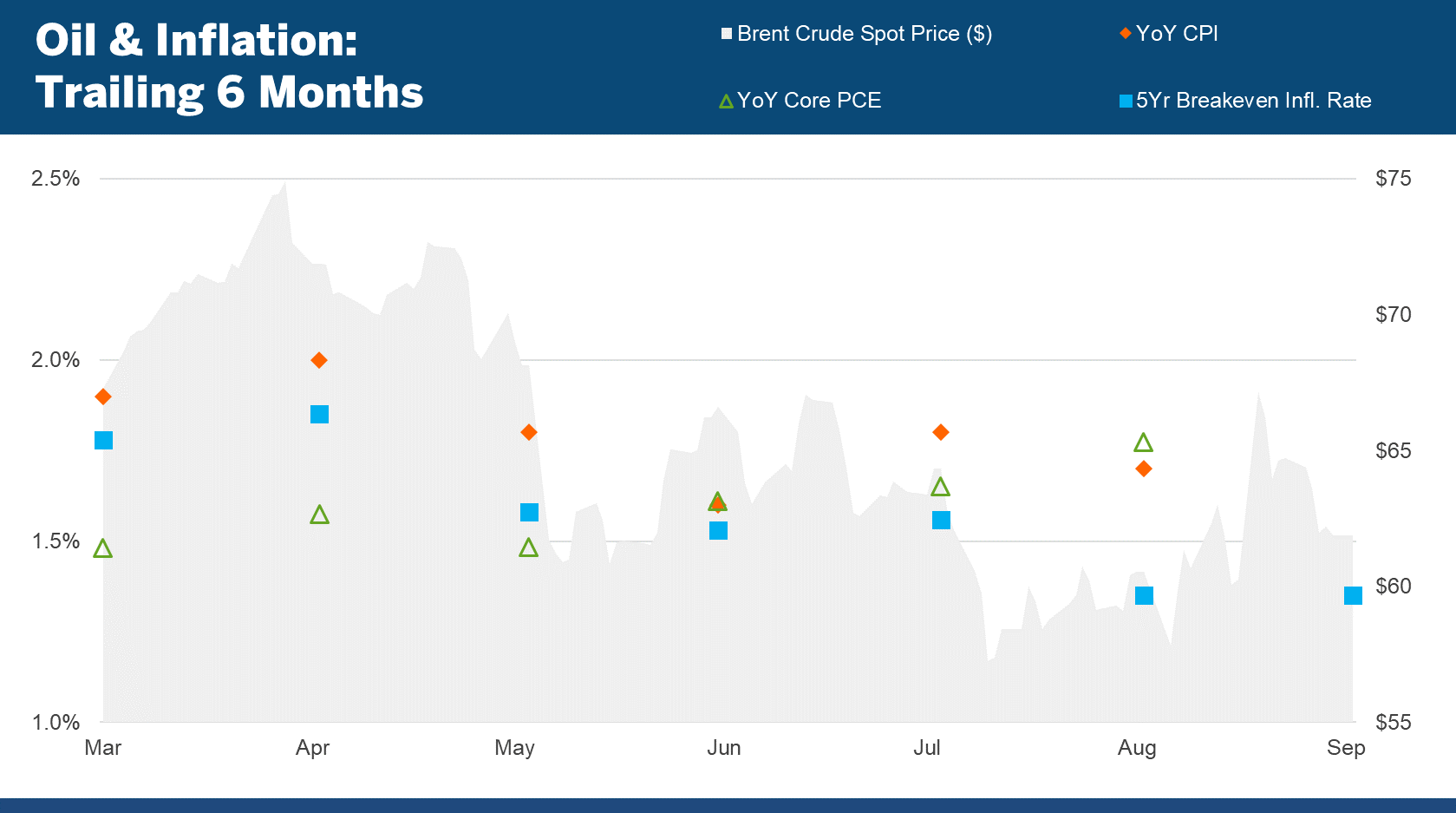

Notwithstanding the attack on the Saudi Aramco oil plant in Saudi Arabia that disrupted production of 5.7 million barrels of oil per day, the price of oil finished the month just 2% higher. The most recent data show inflation remaining below 2%; five-year breakeven inflation rates finished the month unchanged at 1.4%:

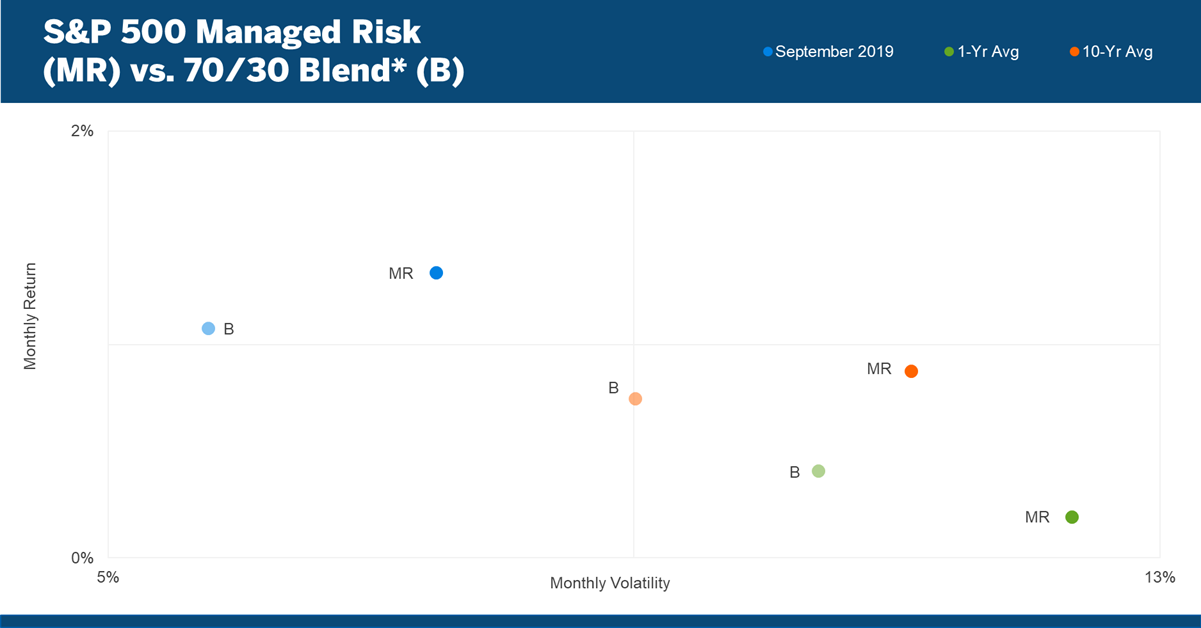

In an almost mirror image of August, the volatility of the S&P 500 began September above the 18% volatility threshold of the S&P 500 Managed Risk Index , but declined steadily as the month wore on, resulting in the S&P 500 Managed Risk Index increasing its equity allocation from 75% at the beginning of the month to 100% by month end.

The average monthly return of the S&P 500 Managed Risk Index over the last 10 years has exceeded that of a 70/30 stock/bond blend1 by 13 basis points. This translates to an annualized excess return of 151 basis points.

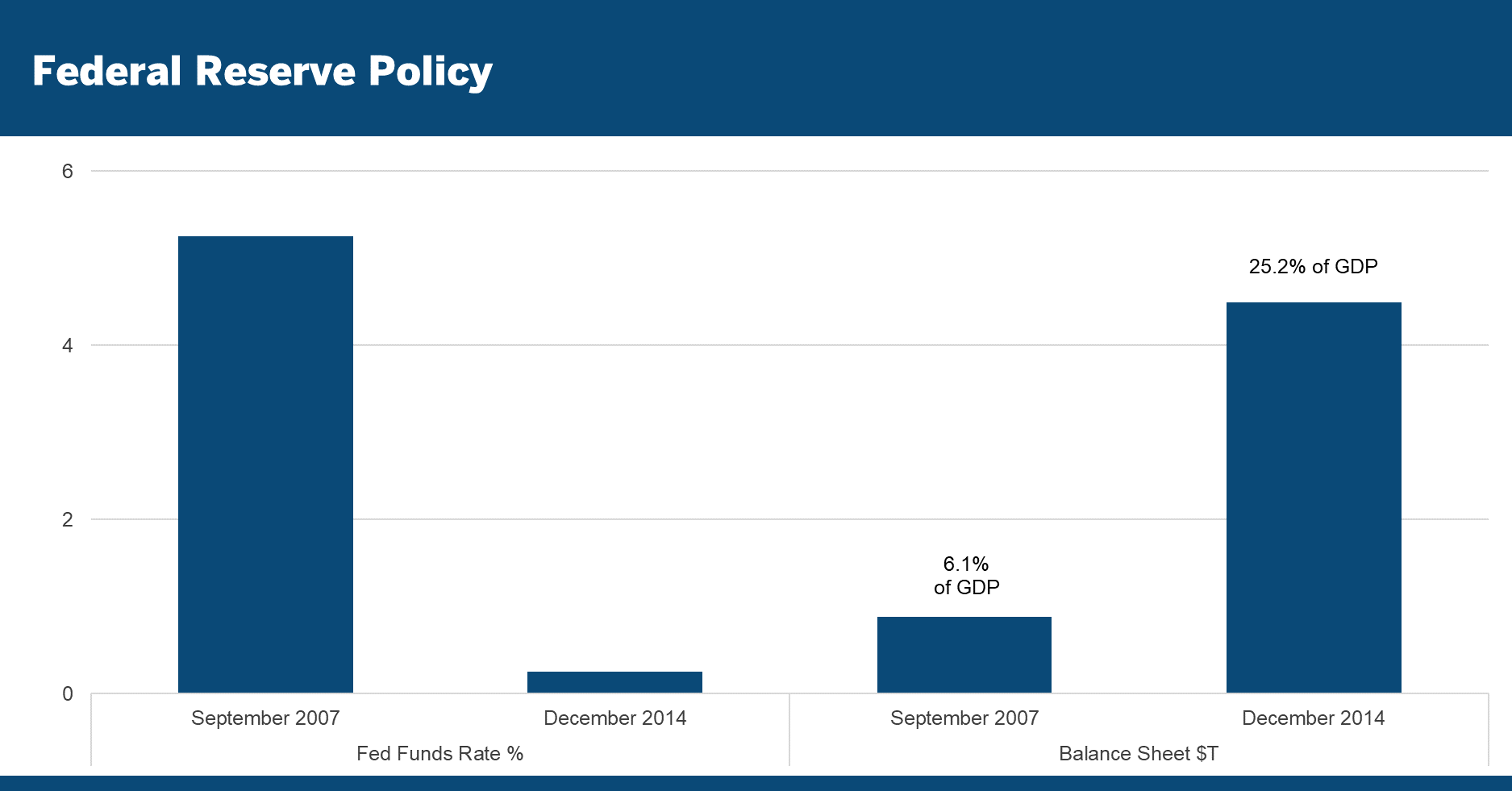

Evolution of Fed Policy: From Active Management of Reserves to Active Management of the Reserve Buffer

When the end of its quantitative easing was on the horizon, the Fed began to convey its intention to normalize its policy. The Fed states on its website that normalization of monetary policy, “refers to plans for returning both short-term interest rates and the Federal Reserve's securities holdings to more normal levels.” It does not say what it means by normal.

The following is a brief timeline of how Fed policy has evolved over the last five years.

September 2014 After three rounds of quantitative easing (QE) over the course of nearly six years, the Fed announced its Policy Normalization Principles and Plans. These plans included the following:

- During normalization, the Federal Reserve intends to move the federal funds rate into the target range set by the FOMC primarily by adjusting the interest rate it pays on excess reserve balances.

- During normalization...the Committee will use an overnight reverse repurchase (repo) agreement facility only to the extent necessary and will phase it out when it is no longer needed to help control the federal funds rate (emphasis added).

- The Committee intends that the Federal Reserve will, in the longer run, hold no more securities than necessary to implement monetary policy efficiently and effectively, and that it will hold primarily Treasury securities, thereby minimizing the effect of Federal Reserve holdings on the allocation of credit across sectors of the economy (emphasis added).

December 2014 The Fed ended its third round of QE, bringing an end to its balance sheet expansion. For the next three years it maintained the size of the balance sheet by reinvesting principal payments. Excess reserves began to decline.

December 2017 The Fed began its balance sheet runoff by reinvesting less than 100% of the principal payments it received. This removed reserves from the banking system and further reduced excess reserves.

January 2019 The Fed changed course with its normalization plans and announced its intention to continue operating in an abundant reserves regime, which would require the ongoing use of an overnight reverse repo facility.

March 2019 The Fed announced a revision to its Balance Sheet Normalization Principles and Plans, stating that it:

1. Was prepared to adjust any of the details for completing balance sheet normalization in light of economic and financial developments.

2. Would begin a slower pace of balance sheet reduction starting in May 2019

3. Would conclude its balance sheet reduction at the end of September 2019, and resume its practice of reinvesting principal payments.

Interestingly, the statement notes that controlling the fed funds rate in an abundant reserves regime through its administered rates means that “active management of the supply of reserves is not required.”

It goes on to say, however, that the Fed will on the one hand, “increase its securities holdings to keep pace with trend growth of the Federal Reserve’s non-reserve liabilities and maintain an appropriate level of reserves in the system,” but on the other hand “will hold no more securities than necessary for efficient and effective policy implementation.”

July 2019 The Fed announced it would conclude its balance sheet reduction at the beginning of August, two months earlier than originally planned.

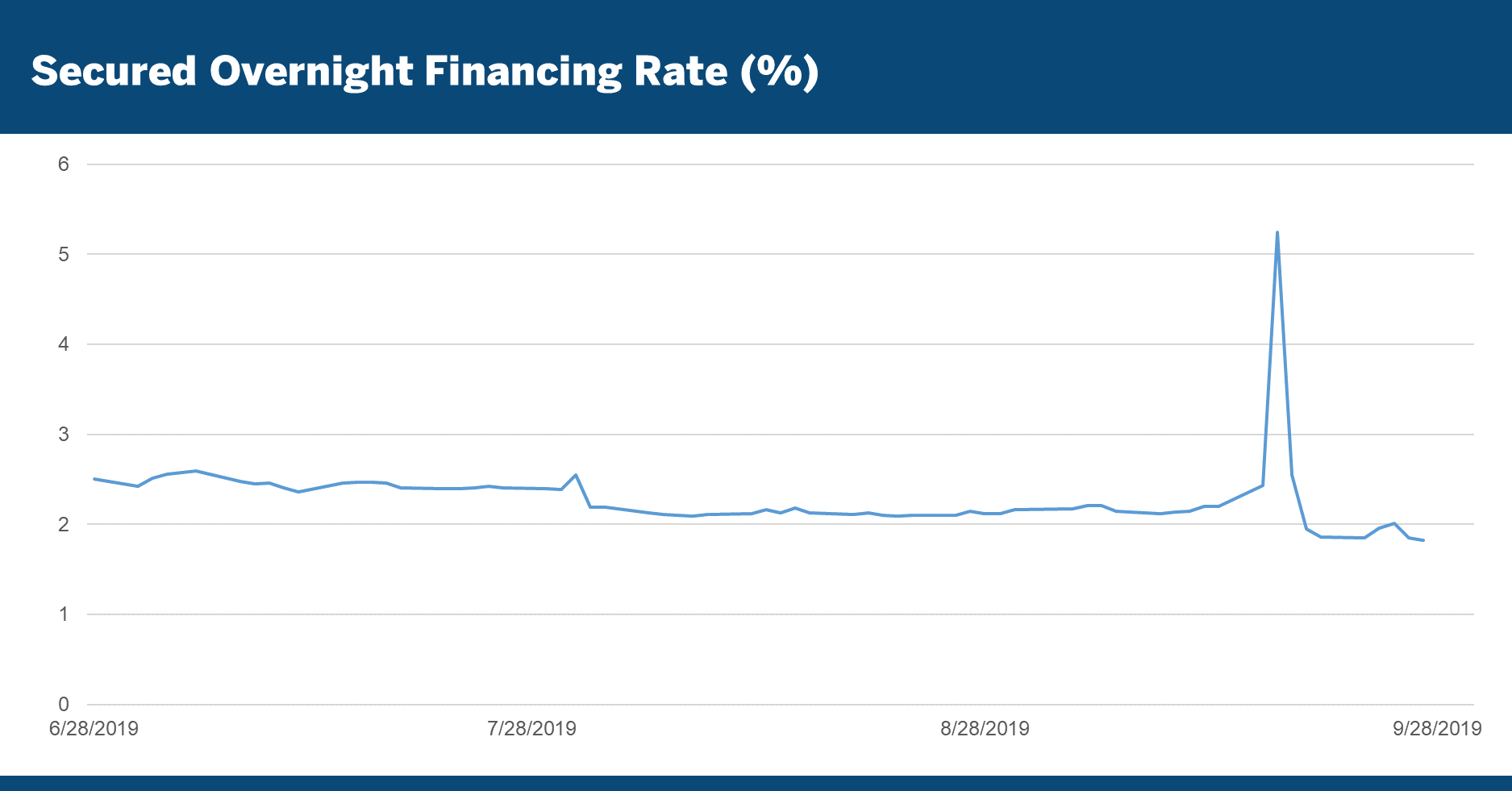

September 2019 On the first day of the Fed’s September 17-18 meeting, the Secured Overnight Financing Rate (SOFR), which generally moves with the Fed funds rate, spiked to 5.25%, more than double its rate on the previous day:

In response to this spike in rates, the Fed pumped as much as $75 billion per day into money markets via overnight repurchase agreement operations over the course of four days. This event has prompted speculation that the Fed may add a permanent repo facility to its repertoire of operations.

September 2019 On day two of the Fed’s meeting, and after announcing a rate cut, Chairman Powell commented in his post-meeting press conference:

“Going forward, we're going to be very closely monitoring market developments and assessing their implications for the appropriate level of reserves, and we're going to be assessing, you know, the question of when it will be appropriate to resume the organic growth of our balance sheet… it is certainly possible that we will need to resume the organic growth of the balance sheet earlier than we thought. That's always been a possibility, and it certainly is now. Again, we'll be looking at this carefully in coming days, and taking it up at the next meeting.”

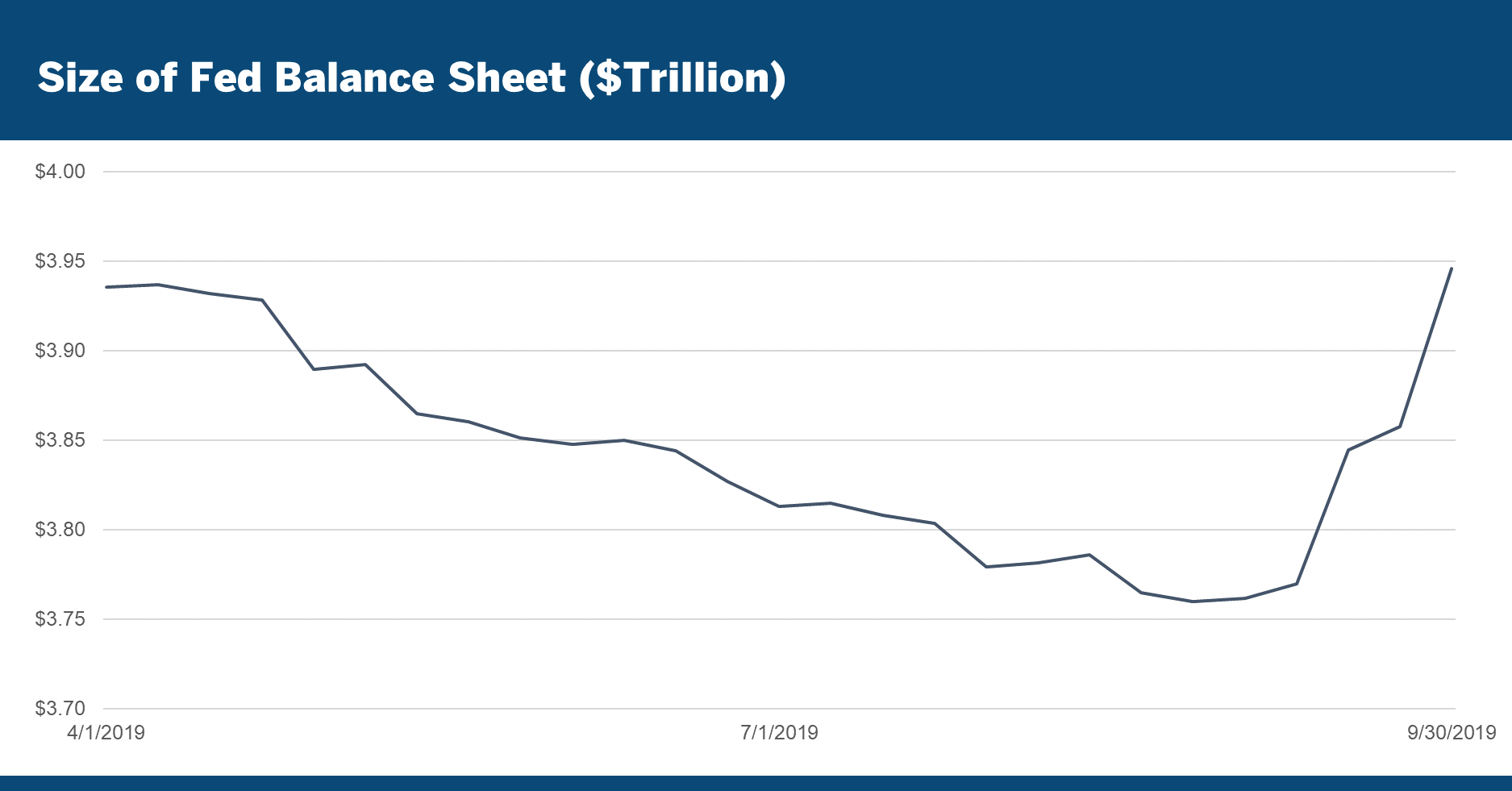

From its post-QE low of $3.76 trillion at the end of August 2019, through the end of September, the Fed’s balance sheet has already grown by nearly $200 billion:

In this context, however, balance sheet growth will be different in purpose and in practice from the balance sheet growth associated with QE.

Importantly, the Fed will not be growing its balance sheet for the purpose of generating downward pressure on longer-term rates or to shorten the maturities of banks’ holdings. Rather, balance sheet growth will be for the purpose of maintaining the reserve buffer (i.e. an amount in excess of the aggregate demand for reserves) that enables the Fed to control the fed funds rate through its administered rates.

Accordingly, in practice, there is not likely to be a prescribed monthly purchase amount, as was the practice during the rounds of QE. Instead, the Fed will likely make purchases in response to changes in demand for reserves (not unlike the way it operated before the crisis), in order to maintain a buffer size it deems sufficient.

While different from QE in purpose and practice, it seems reasonable to ask whether or not this form of balance sheet growth will be different in its effect.

Even while the Fed was letting its $4 trillion balance sheet shrink, it remained a significant source of demand for bonds and continued to generate downward pressure on interest rates. Concluding its balance sheet runoff and resuming balance sheet growth will only see the Fed once again grow, both as a source of demand for bonds and in its overall influence in the financial system.

During the September 18 press conference, in response to a question about whether or not the Fed underestimated the amount of reserves necessary for the banking system, Chairman Powell commented,

“So we’ve always said that it’s—that the level is uncertain, right? And that’s something we’ve tried to be very clear about. And as you know, we’ve invested lots of time talking to many of the large holders of reserves to assess their—what they say is their demand for reserves. We try to assess what that is. We’ve tried to combine all of that together. We put it out so the public can react to it. But, yes, there’s real uncertainty...”

By admitting that the Fed doesn’t really know what the level of reserves should be, Powell seems to be conceding that the Fed can’t merely “set it and forget it,” at least not without massively and somewhat arbitrarily increasing the size of the balance sheet, which the Fed says it doesn’t want to do.

Rather, if the Fed is to stand by its intention “to keep pace with trend growth of the Federal Reserve’s non-reserve liabilities and maintain an appropriate level of reserves in the system,” while at the same time holding “no more securities than necessary for efficient and effective policy implementation,” the Fed will once again be actively managing the supply of reserves. Just six months ago, the Fed said this was not required.

If the Fed is going to actively manage the supply of reserves, regardless of whether or not it’s operating in an abundant reserves regime, it may as well eliminate the excessive balance sheet and its oversized influence in financial markets and the economy. This would enable it to get out of the reverse repo market, stop paying interest on excess reserves, and focus solely on the fed funds rate.

The Fed, however, seems to have little interest in reducing its role and influence back to a pre-crisis level, and instead seems determined to continue expanding it.

1Measured by the S&P 500 and S&P US Aggregate Bond Index

Unless otherwise noted, data is sourced from Bloomberg.

The information, products, or services described or referenced herein are intended to be for informational purposes only. This material is not intended to be a recommendation, offer, solicitation or advertisement to buy or sell any securities, securities related product or service, or investment strategy, nor is it intended to be to be relied upon as a forecast, research or investment advice.

The products or services described or referenced herein may not be suitable or appropriate for the recipient. Many of the products and services described or referenced herein involve significant risks, and the recipient should not make any decision or enter into any transaction unless the recipient has fully understood all such risks and has independently determined that such decisions or transactions are appropriate for the recipient. Investment involves risks. Any discussion of risks contained herein with respect to any product or service should not be considered to be a disclosure of all risks or a complete discussion of the risks involved.

The results shown are historical, for informational purposes only, not reflective of any investment, and do not guarantee future results. Any reference to a market index is included for illustrative purposes only, as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the results of an actual investment portfolio.

The recipient should not construe any of the material contained herein as investment, hedging, trading, legal, regulatory, tax, accounting or other advice. The recipient should not act on any information in this document without consulting its investment, hedging, trading, legal, regulatory, tax, accounting and other advisors. Information herein has been obtained from sources we believe to be reliable but neither Milliman Financial Risk Management LLC (“Milliman FRM”) nor its parents, subsidiaries or affiliates warrant its completeness or accuracy. No responsibility can be accepted for errors of facts obtained from third parties.

The materials in this document represent the opinion of the authors at the time of authorship; they may change, and are not representative of the views of Milliman FRM or its parents, subsidiaries, or affiliates. Milliman FRM does not certify the information, nor does it guarantee the accuracy and completeness of such information. Use of such information is voluntary and should not be relied upon unless an independent review of its accuracy and completeness has been performed. Materials may not be reproduced without the express consent of Milliman FRM. Milliman Financial Risk Management LLC is an SEC-registered investment advisor and subsidiary of Milliman, Inc.

The S&P Managed Risk Index Series is generated and published under agreements between S&P Dow Jones Indices and Milliman Financial Risk Management LLC.

Explore more tags from this article

About the Author(s)

Joe Becker

Contact us

We’re here to help you break through complex challenges and achieve next-level success.

Contact us

We’re here to help you break through complex challenges and achieve next-level success.